Q: Jack emailed last week asking, “Dear Derek, is it time to revisit the idea of converting some of my IRA savings to a Roth IRA I opened but haven’t funded for a number of years?”

A: Jack your question couldn’t be timelier. The new SECURE Act, for which I have written about recently, brings back a strong need to analyze whether a full or a series of conversions, called “micro-conversions”, could be beneficial for many retiree’s estates and their non-spousal heirs. First, let’s take a quick look at why Roth IRAs have a number of advantages over traditional IRAs:

- Lower overall taxable income long-term;

- Tax-free, rather than tax-deferred growth;

- No required minimum distributions (RMDs) at age 72;

- Tax-free withdrawals for beneficiaries after the death of the owner;

- More effective funding of the bypass trust; and

- Facilitates 3.8% net investment income tax (NIIT) planning and income smoothing.

Now, whether a Roth conversion will be favorable for a particular taxpayer, however, depends on the facts of each individual case. Although a Roth conversion might make sense more often than not, a detailed quantitative analysis is required to determine whether it provides an overall economic benefit in a particular case. This analysis begins with a comparison of the taxpayer’s marginal income tax rate at the time of the conversion and the taxpayer’s expected marginal income tax rate when distributions are received. If the tax rate at the time of the conversion is lower, the taxpayer will achieve a better economic result by converting it. If the tax rate is expected to be far higher than when distributions are received, the taxpayer will generally be better off not converting. If the tax rate at the time of conversion is expected to be slight to moderately higher than at the time of distribution, a Roth IRA conversion might still be advisable because of special factors that favor a Roth IRA.

Perhaps the most important of these factors is that if a taxpayer can pay the Roth conversion tax with outside funds he or she can, in effect, pack more value into the IRA.

Example 1

Wilma is a single taxpayer in a 40% combined federal and state income tax bracket in 2020. She has $1,000,000 in a traditional IRA and $400,000 of liquid assets in a side fund, which may be used to pay the taxes from a Roth IRA conversion if Wilma chooses to do one. Assume that the assets in the IRA will increase in value by 300% by the time Wilma retires in 30 years, but the side fund will grow by only 200% because it is subject to tax. At the end of the 30- year period, Wilma will receive a distribution of the full amount in the IRA and will be in the same 40% marginal income tax bracket. The charts below compare the terminal wealth from a traditional IRA and a Roth IRA.

A. No Conversion—Leave assets in Traditional IRA

Beginning Balance $ 1,000,000

Conversion Tax $ 0

Value after Conversion Tax $ 1,000,000

Value after 30 Years (4 x $1,000,000) $ 4,000,000

Tax on Distribution (0.4 x. $ 4,000,000) $(1,600,000)

Amount after Distribution Tax $ 2,400,000

+ Value of Side Fund (3 x $ 400,000) $ 1,200,000

Total Terminal Wealth $ 3,600,000

B. Roth IRA Conversion – Don’t use side fund to pay the conversion tax

Beginning Balance $ 1,000,000

Conversion Tax $ 400,000

Value after Conversion Tax $ 600,000

Value after 30 Years (4 x $600,000) $ 2,400,000

Tax on Distribution $ 0

Amount after Distribution Tax $ 2,400,000

+ Value of Side Fund (3 x $400,000) $ 1,200,000

Total Terminal Wealth $ 3,600,000

C. Roth IRA Conversion – Use side fund to pay the conversion tax

Beginning Balance $ 1,000,000

Conversion Tax (use side fund) $ 400,000

Value after Conversion Tax $ 1,000,000

Value after 30 Years (4 x $1,000,000) $4,000,000

Tax on Distribution $ 0

Amount after Distribution Tax $4,000,000

+ Value of Side Fund (eliminated to pay tax) $ 0

Total Terminal Wealth $ 4,000,000

The $400,000 difference is due to the fact that the $400,000 side fund was, in effect, added to the value of the IRA rather than continuing to grow at its taxable rate. Thus, the difference is ($400,000 x 4) – ($400,000 x 3) = $400,000.

There are many other factors that might favor a Roth IRA conversion:

- A taxpayer has special favorable tax attributes, including charitable deduction carryforwards, investment tax credits, net operating losses, high basis nondeductible traditional IRA, etc., that may help offset the taxable conversion amount.

- Suspension of the minimum distribution rules at age 72 provides a considerable advantage to the Roth IRA holder if the holder doesn’t need the payments for support and can accumulate them for transfer to their heirs.

- Taxpayers benefit from paying income tax before estate tax (when a Roth IRA election is made) compared to the income tax deduction obtained when a traditional IRA is subject to estate tax.

- Taxpayers making the Roth IRA election during their lifetime reduce their overall estate, thereby lowering the effect of higher estate tax rates.

- Federal tax brackets are more favorable for married couples filing joint returns than for single individuals; therefore, possibly lowering the conversion tax if the taxpayer is married. Also, Roth IRA distributions won’t cause an increase in tax rates for the surviving spouse when one spouse is deceased because the distributions are tax-free.

- Post-death distributions to beneficiaries are tax-free which is especially important after the Secure Act Ten-Year.

- Tax rates are expected to increase in the near future.

- The 3.8% NIIT – Roth IRA distributions are not included in net investment income or MAGI.

- The 199A Deduction – Roth IRA distributions will not increase taxable income for 199A and conversion could actually increase the deduction in certain circumstances.

Roth conversions to take advantage of these factors fall into four categories:

- Strategic conversions: Taking advantage of a client’s long-term wealth transfer objectives.

- Tactical conversions: Taking advantage of short-term client-specific income tax attributes that are set to expire (i.e., low tax rates, tax credits, charitable contribution carryovers, current year ordinary losses, net operating loss carryovers, AMT, etc.).

- Opportunistic conversions: Taking advantage of short-term stock market volatility, sector rotation, and rotation in asset classes.

- Hedging conversions: Taking advantage of projected future events that will result in the client being subject to higher tax rates within the near future.

Avoiding the 3.8% NIIT The 3.8% NIIT created an additional reason for doing a Roth IRA conversion—income smoothing. Recall that the amount of net investment income subject to the 3.8% NIIT is the lesser of:

- Net Investment Income (NII), or

- The excess of MAGI over the applicable threshold amount (ATA).

Distributions from a traditional IRA are not considered NII, but they do increase MAGI. Thus, they could create or increase a taxpayer’s NIIT. By contrast, a Roth IRA distribution is neither NII nor MAGI, so it does not create or increase a taxpayer’s NIIT. Therefore, a taxpayer can use a Roth IRA conversion to keep future income out of higher brackets and eliminate all future NIIT on IRA distributions.

Traditional IRA Roth IRA

Impacts MAGI YES NO

NII NO NO

Example 2

Taxpayer (T), filing single, has a salary income of $100,000 and a dividend income of $100,000. T is not subject to the NIIT despite having $100,000 of NII because his MAGI does not exceed his ATA ($200,000 – $200,000). If later, T also receives a $75,000 RMD from his traditional IRA, the NIIT will apply to the lesser of NII ($100,000) or the excess of MAGI over ATA ($275,000 – $200,000). Thus, the traditional IRA distribution will subject T to NIIT on $75,000 of income. If instead, the traditional IRA had previously been converted to a Roth IRA and T received a distribution of $75,000, T would not be subject to any NIIT; his MAGI would not exceed his ATA because a distribution from a Roth IRA does not count towards MAGI ($200,000 – $200,000).

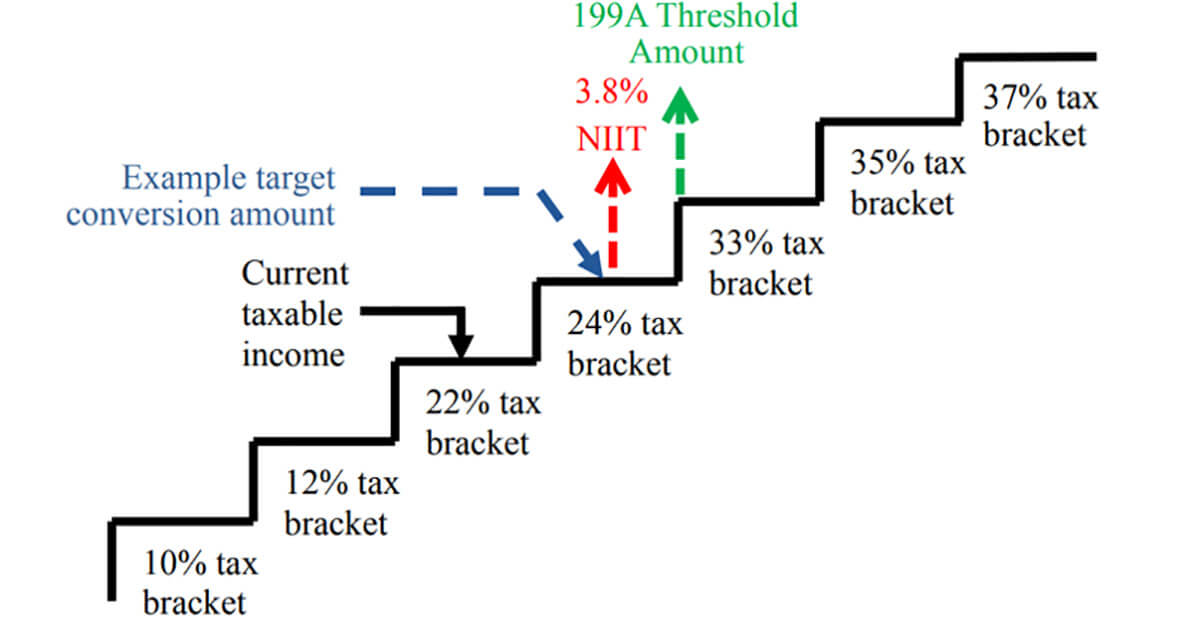

Analysis of Roth IRA Conversions If a taxpayer’s income is currently lower than it is expected to be in later years, the taxpayer might want to do a Roth conversion to “smooth out” income. The conversion can be done in stages so that the tax payable on the conversion does not push the taxpayer into a higher tax bracket or increase MAGI and NIIT in the year of conversion. Taxpayers can limit annual conversions to the amount that fills up their current marginal tax bracket. It should be noted, however, that there may be times when it does make sense to convert more and go into the higher tax brackets.

Re-characterizing a Roth IRA Conversion Prior to the 2017 Tax Cuts and Jobs Act of 2017 (TCJA), the ability to re-characterize a Roth IRA back to a traditional IRA if the assets dropped in value, eliminated much of the risk of Roth conversions. Following the Act, however, re-characterizations are no longer allowed.

Faster appreciating assets should generally be held in a Roth IRA rather than a traditional IRA. This is because Roth IRAs have no RMDs; thus, enabling the assets to grow at their higher rate of return for a longer period of time.

Finally, listed below are four steps to planning for a Roth IRA conversion:

- 1. Develop a ten to fifteen-year projection of income and deductions and compare these projections to the various taxes. 10% tax bracket 12% tax bracket 22% tax bracket 24% tax bracket 33% tax bracket 35% tax bracket Current taxable income 37% tax bracket 3.8% NIIT 199A Threshold Amount Example target conversion amount 39

- Develop an analysis to determine the client’s “permanent tax bracket.” The analysis will test whether any “intra-bracket” conversions increase the 3.8% NIIT, the AMT, or impact the Section 199A limitations.

- Develop a series of “bracket-crossing conversions” analyses. Each analysis must be measured autonomously standing on its own and take into account the various taxes.

- Repeat the above taking into account changes in value and the opportunity to recharacterize.

Jack, keep in mind that much of the Roth IRA conversion planning discussed above can be done with our Tax Rate Evaluator and Roth Conversion Software. Please feel free to email me at derek@miser-wp.com for your free analysis.